Leasehold is a form of tenure where one party buys a specified space for a specified time length.

Therefore, when you own a leasehold property you own the lease and the land and building structure is owned by the landlord who is the freeholder. The residential leases expire with the effluxion of time and can be extended under the relevant statute act, however, this does not apply to leasehold commercial properties.

How Does Leasehold Work?

The residential leasehold interest is created in the form of the lease with prescribed clauses that will specify the time length of the lease, ground rent provisions, tenant and landlord obligations. The leasehold interest can be created in various forms – land, property and specified space.

The older leases were normally granted for 99 years, with more modern leases containing 125 or more years. It is not uncommon to find leases containing 999 years which are commonly referred to as ‘virtual freehold’. As a leaseholder, you are responsible for paying a prescribed percentage of service charge towards the maintenance of the building.

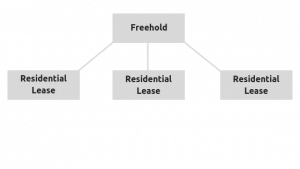

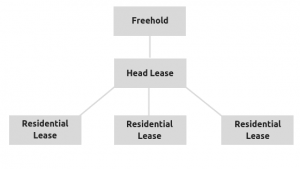

When you own a leasehold property you will have the landlord who will be the party that owns the land and the block where all the flats are situated. Also, depending on the lease structure your landlord can be someone who has a head lease which is a lease above the residential flat leases.

Leasehold structure with no head lease in place

Leasehold structure with a head lease in place

What Is Freehold?

Unlike the leasehold, freehold is the tenure that is held in perpetuity and does not expire with the effluxion of time. The freehold title is an absolute title and is at the top of the chain and can be held for an unlimited period.

When you own the freehold land, you are responsible for any upkeep and repairs. This works out slightly differently if you own a freehold land and there is a building that contains leasehold flats, in this case, the freehold owner/landlord will be responsible for the maintenance of the building, but this cost is recoverable from the leaseholders in the form of service charge.

If The Leasehold Property Is In Scotland And Northern Ireland

The legislation is different in these countries when compared to England & Wales.

In Scotland, all flats are held on the freehold title in form of commonhold which means that common parts and upkeep of the building is managed by a managing agent and flat owners are responsible for contributing to a maintenance fund.

In Northern Ireland, the leasehold legal system is somewhat similar to the England & Wales, with the exception that there is an easier legal mechanism in place to buy the freehold via an application to Land & Property Services. The cost of buying freehold is calculated as 9 times the annual ground rents payable. For more information see Housing Advice Northern Ireland.

What To Look Out For When Buying A Leasehold Property

When buying the leasehold property, you will be instructing different professionals to advise and complete your purchase such as solicitors and valuers. It is recommended that you personally take time to complete due diligence on your lease and prescribed obligations. Also, as part of initial legal due diligence, it is important to take the time to understand the past records of service charge and the future planned works. As these can affect your service charges significantly in the future. For example, if there are any majors works planned such as elevator replacements or external decorations and depending on the block size these works can run into five or six-digit amounts.

Cons of Owning A Leasehold Property

When you own the leasehold property, you will incur various expenses associated with the property. These elements below can be applicable depending on the lease:

- For the upkeep of the building, you might be required to pay a service charge.

- Your lease might have prescribed ground rents.

- Your property is always on the lease which diminishes with time.

- There will be some form of insurance payable.

You need to understand the associated costs above as these can add up significantly. If you have never owned the leasehold property before, these costs can come to a bit of a shock at first, therefore it is always good to know what you are getting yourself into beforehand (from costs perspective). The services charge contributions usually are equally split between the leaseholders but can also slightly differ from each other depending on whether you use certain common services.

The leasehold property communal areas and block structure is usually managed by specialist leasehold block management company instructed by your landlord. There are cases where management companies in place tend not to do the best of the job and something may be left unattended. However, this issue can be tackled by leaseholders joining together to form their own management company via ‘right to manage’ or buying freehold via collective enfranchisement.

Under Section 42 Landlord and Tenant Act 1993, you are allowed to extend your lease for an additional 90 years on top of existing term. But this comes with the cost as you have to compensate your landlord for granting you an extension. You will need to instruct a specialist lease extension surveyor to provide you with lease extension valuation report which will detail how much you will need to pay your landlord to for a right to extend the lease.

If you are planning to purchase a leasehold property based on the lease term remaining you can check how much it would cost for you to extend your lease with our free lease extension calculator.

Who Exactly Manages The Leasehold Block?

As mentioned above usually the landlord appoints a specialist management company to deal with the upkeep of the block. The management company can be a contractor that is instructed by the landlord or it can be the management company that was formed by leaseholders via ‘right to manage’ and they themselves undertake the management of the building.

The specialist management companies are usually members of ARMA and IRPM with accreditation in leasehold property management.

The good management company has all systems in place to effectively manage the block and will prepare the maintenance schedules way in advance, letting the leaseholders understand what works are planned for a year and sometimes way more in advance.

The management company will hire different contractors to undertake upkeep of the building. For example, contractors can be hired to undertake – cleaning, gardening, repairs, security and etc. These contractors will be usually hired on a periodic basis with a contract in place for a certain time length.

All these costs will be included in the annual service charge demand which is payable by all leaseholders in the block in accordance with their set lease provisions.

Service Charge

The service charge depending on the management company processes in place will be charged on the annual basis. The service charge budgets are made from estimates and actual budgets.

For example, if your service charge accounting year ends in September, the management company will prepare a service charge budget estimates for the next year and the actual expenditure for the current year up to September.

The service charge for the current year will show the actual expenditure and will either contain surplus or deficit and along with this, the next year service charge estimate will be sent as well requiring the leaseholders to make the payment.

The actual accounting processes will differ in each management company, but this type of service charge budget preparation is the most common in block management.

The service charge and any works payment demands have time limitations and can only be recovered within 18 months from when it is incurred. If your landlord or management company fails to notify or demand the payment within this period then you are not obliged to make any payments and the management company or landlord will need to cover the loss from their own pocket.

What About Maintenance/Repairs To The Communal Parts?

The management company must complete a tender process when introducing a periodic contract worth more than £100 per annum per leaseholder or single repair works worth more than £250 per annum per leaseholder.

This process is prescribed in Landlord and Tenant Act 1985 section 20 which states that if periodic contracts or single repair works exceeds the amounts mentioned above then the management company will have to complete a tender process which is formed of three stages:

- The pre-tender stage – making the leaseholders aware of works planned; and

- The tender stage – obtaining quotes for the planned works; and

- Awarding the contract – with reasons provided for nominating the award.

During tendering, leaseholders are consulted in every stage of the process. You as the leaseholder can raise the observations to the management company’s proposals and nominate your own contractors for planned works.

When the contract is awarded the notice will be sent along with the payment demand to the leaseholders. The payment demands are allocated in accordance with the set lease provisions.

The Right To Information

There can be a lot of issues between parties in the leasehold block whether with managing agents, freeholders or other residents in the block it is imminent at some point in time.

As the leaseholder, you have a right to information about service charges and insurance. These should be disclosed to you at as soon as you request it. If for some reason your landlord or managing agent refuses to disclose these, you have a right to apply to court to force them to disclose the documents.

The disputes can also arise when it comes to the ground rent payments especially if your lease contains RPI linked ground rents increasing every 10 years and etc. These are usually calculated by the landlord’s appointed surveyor.

What To Do If You Have A Complaint To Make

Step 1 – Communicate with the party you believe to be in wrong.

It is always the best to directly communicate with the party you believe to be in wrong. You need to gather as much information as possible on the issue and present it from your point of view. It is recommended that you document the conversations carefully if a complaint is not resolved.

Step 2 – Involve a third party if a complaint cannot be resolved in step 1.

In the instances where you are disagreeing about something with the managing agent and you see that it is progressing nowhere you could seek to involve your landlord in the dispute. Because landlords directly employ the managing agents and if they are clearly at fault this may prompt the agent to resolve the issue more quickly to avoid frustrating their landlord client.

Step 3 – Appoint a mediator to settle the dispute.

When all attempts to settle dispute in a good faith are to no avail you should seek to appoint a mediator. The mediator uses a dynamic, structured and interactive process to assist and help the parties solve the conflict. This type of dispute resolution is always recommended depending on the financial amount involved and could be a lot of cheaper compared with the court and all the legal fees you will incur in the process.

Step 4 – Make the application to the court.

The leasehold disputes initially go through the First-Tier Tribunal (Property Chambers) system. The FTT has a fixed fee of £100 for the application and then £200 fixed fee for the hearing. This is just tribunal fees you will need to add your legal fees on top as well. Therefore, you need to be absolutely sure that it is financially viable to make the application. The tribunal does not make the decision on the date of the hearing and will usually provide a written decision within 6 weeks from the date of hearing.

Step 5 – If you are not happy with the FTT decision you can appeal.

You can appeal the FTT decision within 28 days of the receipt of the written decision, but permission to appeal must be granted first. If the tribunal does not grant the permission to appeal, this can be sought from Upper Tribunal (Lands Chamber). The appeal will be under consideration at the Upper Tribunal level. The Upper Tribunal decisions can also be further appealed if necessary but most of the cases never reach this stage due to financial costs involved.

Frequently asked questions

How To Extend My Lease?

You have a right to extend the lease under Leasehold Reform, Housing and Urban Development Act 1993 for an additional 90 years on top of the existing lease term. After lease extension ground rent becomes ‘peppercorn’ meaning zero.

In order to qualify for the lease extension, you need to meet the set criteria. The main criteria are that you need to own the property for at least two years before you gain this right.

However, it is not the end of the world if you had it for less than two years and still wish to extend. You can do this informally by contacting your landlord to try and reach an agreement. Be warned though, landlords do not have to grant you a lease extension when approached informally.

You can read more about qualifying criteria and process in our blog article about lease extension

What To Do About Onerous Ground Rents?

If you have a ground rent provision that reads like £500, £1000, £2000 per annum and rising, you are in trouble. You might have heard about the case of large housebuilder Taylor Wimpey ground rent scandal and that they agreed to set aside £130 million fund for those affected.

However, if you are an average leaseholder there is not much you can do about it. When you sign the lease, you agree to the contractually binding agreement between yourself and the other party.

The best way to get rid of the ground rents is to extend the lease in accordance with the statutory process which will make ground rents obsolete after the lease extension. An alternative way to approach this is via collective enfranchisement of the freehold, but there are strict rules regarding eligibility which first must be met

Onerous ground rents can make your lease extension costly. Waiting longer will make it even more expensive and can result in you not being able to afford to extend the lease. You can check the indicative lease extension cost with our free to use leasehold extension calculator. If you require a professional advice contact lease extension surveyor.

Also, majority of the mortgage lenders since all the negative publicity introduced a 0.1% rule on the ground rents which means that your ground rents per annum cannot exceed more than 0.1% of the property value. If this threshold is not met you might not be eligible to buy leasehold property at all or will be restricted to few lenders with not so favourable terms.

How To Check Your Ground rent?

The ground rent provisions are always contained in the lease. It will outline what type of ground rents are in place such as – amounts payable and any future increases. If you cannot locate the lease you can obtain a lease from the land registry, but you will need to request it from a solicitor as land registry restricts public access to leases.

Alternatively, you can obtain a leasehold title extract from the land registry for £3.00 which will show the ground rent provisions. It is not a problem if the lease is above 80 years. Generally, it is slightly more difficult to get the mortgage if your lease falls below 80 years as this will limit the number of lenders willing to lend on the leasehold property.

The Council of Mortgage Lenders suggests that lenders require that leases to extend to at least 40 years beyond the end of mortgage term.

When purchasing the leasehold property, you should keep this in mind. However, this is not a set rule and will vary from lender to lender. Also, you might be subject to shorter mortgage term and higher interest rates which will increase your monthly mortgage outgoings if you have a short lease.

How Can You Buy The Freehold From The Landlord?

The other leaseholders will need to join you in buying the freehold from your landlord with a minimum of 50% leaseholders joining the freehold enfranchisement process. There are further criteria which need to be met to be eligible for buying the freehold.

You are required to pay your landlord the compensation for the loss of the freehold and this could run into thousands of pounds. More information about this can be found in our blog article about collective enfranchisement process.

Can You Keep Pets At The Leasehold Property?

Most of the leases contain a restrictive clause that prevents housing any pets within the leasehold property. In this instance, you would need to seek permission from your landlord, but he could refuse it.

Generally, there are two types of clauses on pets – one which state that permission must be sought before housing any pets – the other where it completely restricts the pets. With the former, you can obtain consent but usually, a clause will contain an addition stating that consent can be withdrawn at any time upon nuisance complaint.

If there are no clauses about pets in the lease your landlord will have difficulties trying to enforce no pet rule in the leasehold block.