The guidance to lease extension process

It is estimated that in the United Kingdom there is in excess of 2.5 million leasehold flats held on varying lease terms.

Therefore, if you own the flat you will have lease that prescribes the length of the lease, the date it was granted, ground rent provisions (if any), your obligations as leaseholder and your landlord obligations towards the property.

When you own the leasehold flat, legally you are classed as a tenant that has the benefit to enjoy the prescribed demise for a specified time. When this time comes to an end the prescribed demise reverts to the freehold. To avoid this situation, you can exercise your right to extend the lease by using prescribed procedures in the Leasehold Reform, Housing and Urban Development Act 1993 (as amended).

The 1993 Act gives you a right to extend your lease for an additional 90 years lease extension on top of an existing term with peppercorn ground rent.

The peppercorn is the terminology used which means that any ground rents if prescribed in the lease after statutory lease extension is completed will become zero.

In order to extend the lease a sum to the landlord for the statutory lease extension needs to be paid. The landlord is entitled to be reimbursed for the loss of ground rents, the reversionary value of your flat and marriage value if applies.

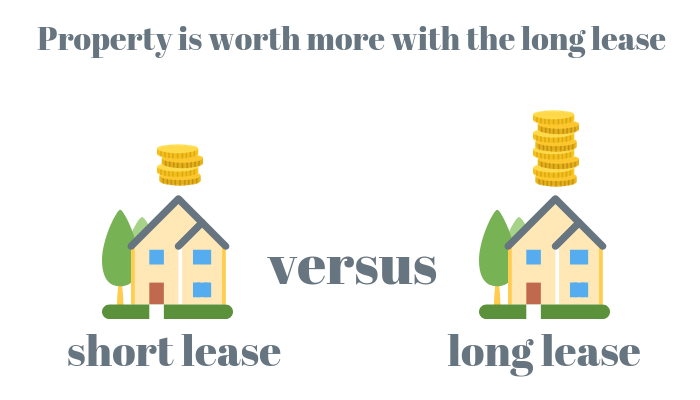

What is marriage value?

The marriage value is applicable when your lease falls below 80 years. In the simple terms, marriage value is the difference between the value of the property on a short lease and the value of the property on the long lease.

Here is the hypothetical example:

The property has 70 years on the lease remaining, and the current market value with a short lease is £70,000. If the same property would have lease above 80 years it would be worth £100,000, so the difference in this instance would be £30,000, and this would be called marriage value. In the valuation methodology, marriage value is split equally between the tenant and landlord and this means that the landlord’s equal share is added to the total of the lease extension premium.

Generally, property value becomes affected once the lease falls below 80 years. Therefore, it is always recommended to extend your lease early. Allowing lease to fall below 80 years, will increase the premium significantly when compared to extending leases with remaining terms of more than 80 years.

Lease extension process

There are several nuances that you will need to consider before proceeding with the lease extension:

- Establishing whether you qualify to extend the lease (see further below);

- Instructing a specialist lease extension valuation surveyor to provide lease extension valuation;

- Once you know the likely premium you will need to arrange your finances to pay for further professional fees and premium;

- Instructing a solicitor to formally act and prepare required notices; and

- Preparing for subsequent procedures that can involve negotiations and application to the tribunal.

Eligibility

Checking whether you qualify early is paramount, otherwise, there is no point financially to instruct the valuer to prepare a valuation when in the end you will find out that you cannot extend the lease until a certain time or at all.

To be able to extend the lease formally, you will need to meet the criteria below:

- You need to be a ‘qualifying leaseholder’ which is defined as a long lease granted for more than 21 years from the time it was originally granted; and

- Have owned the property for at least two years.

Even if you meet the above criteria, you cannot initiate a formal lease extension process if one of these cases below applies to your situation:

- The landlord is a charitable trust and the flat is provided as part of charity’s functions;

- It is a commercial lease or business; or

- If you are in shared-ownership and do not own 100% share. You would need to staircase to a 100% if you wish to formally extend the lease, otherwise, the only option you have to extend the lease is through informal way via your housing association.

In instances, where you are ineligible because of 2 years timeline you can always try to approach your landlord via informal way to obtain a lease extension. However, as there is no way to force your landlord to grant you a lease extension you might not necessarily achieve the best deal if done this way.

Lease extension valuation

Once you know that you are eligible, you will need to instruct the valuer to prepare a lease extension premium valuation.

You should note that lease extension valuation is not an exact science and is evidence, case law and chartered surveyors’ interpretations. Therefore it is recommended to ensure that you’re instructing only a specialist lease extension surveyor to provide you with an accurate estimate as there is no such thing as a fixed price.

The valuer will evaluate the premium from both perspectives – leaseholder’s and landlord’s, taking into consideration the different valuation variables used when acting for the leaseholder and when acting for the landlord. The valuer will provide several estimates that will show the most likely settlement range in the format of ‘best and worst’ case figure. Even with this, sometimes premium settled can end up way over the original worst estimates.

This can happen in some cases where the landlord’s valuer has superior evidence to that possessed by leaseholder’s valuer, and this usually drives the premium figure up. In order to understand why this can happen you need to understand a basic leasehold valuation variables used.

As mentioned above chartered surveyors determine the premium by manipulating and valuing different applicable variables in the lease such as: the length of the lease, long lease market value, short lease market value, ground rent provisions, relativity and marriage value. Each of these can inflate or decrease the premium depending on how much or how long they are.

For instance, when you are extending the lease, the shorter the lease is the more expensive it will be, and your short lease value will be lower compared to that of a long lease.

If you have any ground rents in place you will need to compensate the landlord for the loss of the ground rent income including any rising ground rents in the future. The higher the ground rents, the higher the premium will be.

Relativity and marriage value applies when your lease runs below 80 years and as mentioned above it can significantly inflate the premium. The relativity is the term used to discount the long lease market value to derive the short lease value.

The relativity is usually the most contentious variable in the negotiations and is expressed as a percentage. It is derived from either relativity graphs that incorporate historic lease extension transactions or comparable evidence of sold short leases in the locality.

The marriage value which is the difference between a short lease and a long lease is calculated and equally split between the landlord and the leaseholder, with landlord’s share added to the premium total. Depending on who surveyor is acting but commonly is surveyor is acting for leaseholder they will try to push the relativity as high as possible to save on marriage value and landlord’s surveyor will do the opposite.

If you need to understand an indicative lease extension premium you can use our lease extension calculator which will provide you with a premium range.

Instructing a solicitor and preparing for serving the Section 42 notice

When choosing to instruct a solicitor it is generally not advisable to proceed with your family solicitor just because you use him every time. Choosing the right solicitor is crucial in the lease extension process, as one mistake can cost you time and money to rectify. Therefore, it is always recommended that you choose a solicitor who predominantly specialises in leasehold reform work and has a demonstrable record in dealing with lease extensions.

The solicitor is responsible for taking care of the below:

- Gathering and preparing the information for the notice;

- Serving the notice on the competent landlord and other landlords if any;

- Making sure that landlord requests for information to support the claim are responded to;

- Application to a tribunal if a premium settlement cannot be reached during negotiations; and

- Dealing with the conveyancing of the lease.

You should also make sure that solicitor has professional indemnity insurance in the event of the claim. However, if you choose the right professional it is highly unlikely that this will be required.

Specific information solicitor collects before serving the Section 42 notice

Your solicitor before serving the notice will need to do some investigatory work collecting the right information about you, your property titles and any other party interests involved. This is mainly completed that all information is correct and valid when notice is served and to respond to any landlord requests to provide information. If notice is not served correctly it can be deemed invalid, which will mean that it will have to be served again and will involve extra costs and result in time wasted.

Usually, solicitor will help you to collect the right information about:

- Collecting information about the landlord who must be deemed as a competent and identify the correct address with either a person or company name depending who holds the interest;

- To check the tiles whether there are any head leases and find the address and names of the head leases; and

- Extract from the land registry the subject lease and registered freehold and leasehold title.

Establishing finance

This is important because if you do not have the money upfront you will need to get some sort of financing in place to fund the lease extension premium. When establishing finance, you need to consider:

- The total of your professional fees;

- Estimated premium (It is suggested to make finance allowance on the worst-case estimate);

- Allowance for covering landlord reasonable costs; and

- Applicable stamp duty.

To expand on this, when you are extending the lease you are also responsible for your landlord’s incurred fees and these include the solicitor and valuer. Also, the stamp duty is payable on the lease extension and will depend how much on the amount of the agreed premium.

The amount you must cover for landlord expenses will usually be somewhat similar to what you paid in professional fees to your solicitor and valuer.

When your solicitor serves the section 42 notice, the landlord on the receipt of the notice might request the payment of deposit which can be either £250 or 10% of the premium served in section 42 notice, whichever is greater. If you decide to withdraw from the claim you will be liable for all the landlord’s reasonably incurred costs.

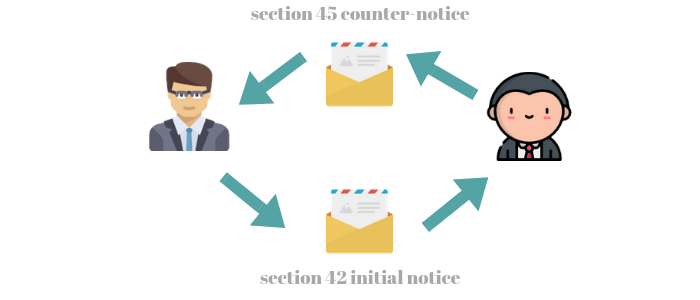

Serving section 42 notice

There are requirements set out in the Leasehold Reform Housing and Urban Development Act 1993 which require the notice to contain the following:

- Leaseholder’s full name and the address of the property;

- Provide enough information that identifies the property to which notice relates;

- State the terms of the lease e.g commencement date and other provisions;

- If there are any different terms proposed by the leaseholder other than in the original lease, then this requires to be stated in the notice;

- The name and address of the leaseholder’s representative solicitor; and

- The notice should contain the date by which landlord must respond with the counter-notice (This must be the date at least two months after the notice was served).

As mentioned before it is really important to get all the details right from the first time it is served. Any misdescriptions or missing parts can prolong the process and require an application to the tribunal to rectify and incur extra costs. The notice can also be made invalid because of this.

When notice is served, the valuation date is fixed and when your landlord responds with the counter-notice their valuers will have to prepare the valuation of your premium on the date of section 42. If the process is prolonged due to the negotiations and other factors, the date is still fixed until it can be agreed or enforced.

Subsequent procedures

When you serve the notice, you will have to wait at least two months before you receive the landlord’s counter-notice called section 45. The counter-notice will usually state that the landlord admits that the tenant had a right on the relevant date to a lease extension on his flat. In addition to this, the landlord needs to state which proposals he accepts and which he does not. In most of the cases, the landlord will contest the premium and provide a counter premium.

With the counter premium in mind, you should discuss the next course of action with you valuer. The valuer will evaluate the counter premium and will be able to provide advice from a monetary perspective whether it is worth to proceed with negotiations or not. If the difference between premiums is small sometimes it is just better to accept because you will avoid incurring the valuer’s negotiation fees.

From the date the landlord’s counter-notice is received you have 6 months to reach the agreement with your landlord. If this cannot be reached via negotiations, you will have to make sure that your solicitors apply to tribunal no earlier than 2 months after service of counter-notice but no later than 6 months. Otherwise, you lose the right and will have to start with the same process from the beginning.

Absent landlord

There could be situations where the landlord cannot be found, and your solicitor will not be able to serve the section 42 notice. This is not the end and you can still get the lease extension, but your solicitor will have to make an application to county court for a vesting order. The county court will have to be satisfied that you meet eligibility criteria, this should not be a problem and court in effect will grant the lease extension in the landlord’s absence. However, county court will usually refer this to First-Tier Tribunal to determine the premium payable. Further services of valuer will be necessary as he will need to provide more information and try to justify the premium noted in initial lease extension section 42 notice in front of the tribunal.

The terms of the new lease

The new lease will be granted in accordance with legislative requirements set in Leasehold Reform, Housing and Urban Development Act 1993:

- The new lease will be at the peppercorn ground rent which means zero for the whole of the existing term plus 90 years;

- The new lease will add an additional 90 years on top of your remaining term; and

- The new lease should be on the same terms as an existing lease, subject to certain modifications and additions.

These modifications are usually for adding any alterations completed to the flat or the building or to remedy the previous defect in the lease provisions. The restrictive clause is also added to the new leases preventing the grant of the sub-lease of sufficient length.

Furthermore, the new lease should contain a covenant that grants the landlord the right to repossession of the flat for the intention of redevelopment.

This right does not arise until the end of the existing term and again the end of the extended term. The landlord must make a court application for intention to redevelop and if granted the landlord must pay the compensation to the tenant in accordance with a statutory formula. This clause will not affect the mortgage of the property.

Recap of the lease extension process

-

- Instructing professionals and gathering required evidence.

- Leaseholder serves the information notice section 41 (if required).

- The landlord must respond within 28 days.

- The leaseholder’s solicitor serves section 42 initial notice.

- The landlord may request additional information from the leaseholder to support section 42 but he may do so within 21 days of section 42 receipt.

- The leaseholder must respond to the landlord information request within 21 days.

- The landlord must serve the counter-notice within specified deadlines in section 42. This is usually no earlier than two months after receipt of section 42 but no later than six months.

- When the landlord fails to respond with the counter-notice, the leaseholder can apply to the county court and subsequently to the tribunal for a vesting order.

- When counter-notice is received, and no agreement can be reached both parties can apply to the tribunal for determination. This must happen no earlier than two months, but no later than 6 months from the date of counter-notice.

- The tribunal will reach a decision within 28 days from the hearing date. If parties are still not happy with the tribunal’s determination, they can appeal to the Upper Tribunal.

- Once the tribunal decision is determined the draft lease must be provided within 14 days. Both parties must enter into the new lease within 2 months from the date of the tribunal’s decision. If this period lapses and no entry was made for the new lease, the leaseholder must make an application to the court within further two months requiring a landlord to meet its statutory requirements.

- Once everything is agreed you will have a new lease with an additional 90 years on top and peppercorn ground rents.