We have chosen to write this article to outline some of the benefits of why getting a lease extended might be a good idea.

It may be in your best interest to check the current remaining term on your lease. In general, it is accepted by everyone in the industry that if the lease is above 82 years you still are on the safe side and you should continue enjoying the occupation of your property without any worries about losing value due to a short lease.

But if your lease is extremely close to 80 years you should start thinking about a lease extension. Because if you can get the lease extension before the lease falls below 80 years you will save a tremendous sum and by that, we mean thousands of pounds.

The lease length is often overlooked by the leaseholders and it commonly falls below 80 years. This might prove quite devastating financially because extending a lease will cost significantly more compared to the cost of extending when the lease is still above 80 years mark.

Here are some good reasons to extend a leasehold property lease

Extend the lease to remove ground rents

When you extend your property lease on the statutory terms you get rid of ground rents forever!

If you follow a statutory residential lease extension route you can get rid of the current ground rents that you may have. The newly extended lease will be at the peppercorn ground rents meaning zero.

It is very common that leasehold flats have prescribed ground rents ranging anywhere from a pound to thousands of pounds. If your ground rent falls within the latter level then the premium to extend the lease will be significantly higher.

However, it is a necessary step to complete if you do not wish to continue paying ground rents in the long-term. The lease extension is the only way to remove the ground rents from the lease.

If you are paying say a hundred pounds every year and you plan to live in your flat for a long time, removing ground rents might prove beneficial as in the long run you will save extra money.

However, this does not always apply, and the savings you will make may be very low as it all depends on the type of lease structure you have.

Extend the lease to allow a sale completion

If you are a homeowner who is struggling to sell the property because of the short lease – you are not alone. There are more than 2.5 million leasehold properties in the United Kingdom and in one way or the other some issue will pop up during the sales process either delaying or preventing a sale.

This particularly applies if your buyer is using a traditional homeowner’s mortgage to purchase the property from you, their lenders might not be so keen to lend on a leasehold property with a short lease. In leasehold terminology, a short lease is considered any lease with a remaining term below 80 years.

You as the property owner have the option to avoid this type of situation and you can do that by assigning your right to extend the lease to the buyer. This type of transaction is called Section 42 assignment, so your buyer does not have to wait for 2 years until they qualify for a residential lease extension under Leasehold Reform, Housing and Urban Development Act 1993.

Extend the lease for mortgage purposes

As mentioned above, leasehold interest is created for a fixed time period and when the lease term reaches close to 80 years it starts to affect the property value. Normally it is suggested that the lease should be extended prior to it falling below 80 years level. The earlier you extend the cheaper it will be.

The Council of mortgage lenders historically had a list publication containing lenders who do not lend on leases under 80 years. The majority would not lend if the lease is under 80 years. The small majority of lenders who lend on leases below 80 years will likely offer higher than average market interest rates and short repayment periods. Also, your loan-to-value ratio may be affected meaning you will need to put in more deposit to access the mortgage product or have a higher income to afford the mortgage payments.

Therefore, it is paramount to consider extending the lease as soon as possible to avoid this situation.

Extend to avoid extra costs when the lease falls below 80 years

A property with a short lease will be worth less than a property with a long lease.

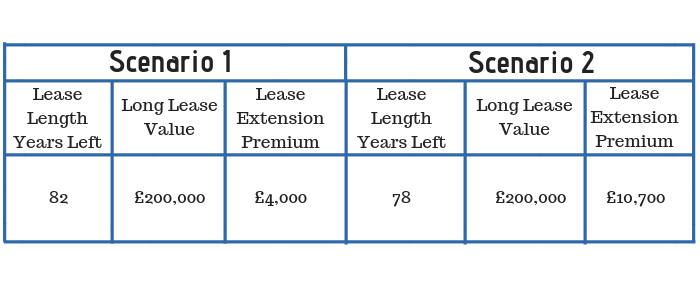

To show a difference between the premiums to extend the lease above 80 years and to extend the lease below 80 years. We produced a table with the following scenarios on the assumption that there are no ground rents:

As you can see four years apart, the cost to extend the lease doubles when it falls below 80 years. Of course, these are only hypothetical scenarios and in real situations premium might not necessarily be double, this all depends on the property location, value and lease terms in place.

This type of increase in premium happens because of a formula called marriage value which is essentially a difference between a short lease and a long lease property values. This difference is then divided equally between you and your landlord and his share forms part of the lease extension premium total.

How to go from here

If you wish to progress with the lease extension you will need to instruct a solicitor and lease extension valuation surveyor.

The solicitor will perform all required checks and serve the correct notices whilst the surveyor will provide a valuation report for a lease extension.

When a lease is finally agreed you will get an additional 90 years extension on top of the existing lease term and your ground rents will be at the peppercorn. This happens only if you extend the lease via a statutory process.

If you are still not sure whether you wish to extend or wait for a better time you can check how much does lease extension cost via our free lease extension calculator.

How long does lease extension take?

The whole residential lease extension process can take anywhere from 6 to 12 months and it all depends on the individual parties and how quickly they progress through each stage. There are statutory limits to responding to different leasehold extension stages. If parties do not adhere to the statutory timeline, then either party can apply to a First-Tier Tribunal for the determination of the premium.